If you’re looking to get started in the stock market, Best Stock Market App can be a great way to do it. But with so many options out there, how do you choose the best one for you? In this blog post, we’ll give you some tips on how to pick the right share market app and make the most of your investment.

What are share market apps?

Share market apps are online platforms that allow you to buy and sell shares of stocks and other securities. They typically charge lower fees than traditional brokerages and offer a variety of features and tools to help you make the most of your investment.

What are the benefits of using them?

Sharemarket apps offer a number of benefits, including:

– Lower fees: Share market apps typically charge lower fees than traditional brokerages. This can save you a lot of money over time, especially if you’re a frequent trader.

– Convenience: Share market app are very convenient, allowing you to trade from anywhere at any time.

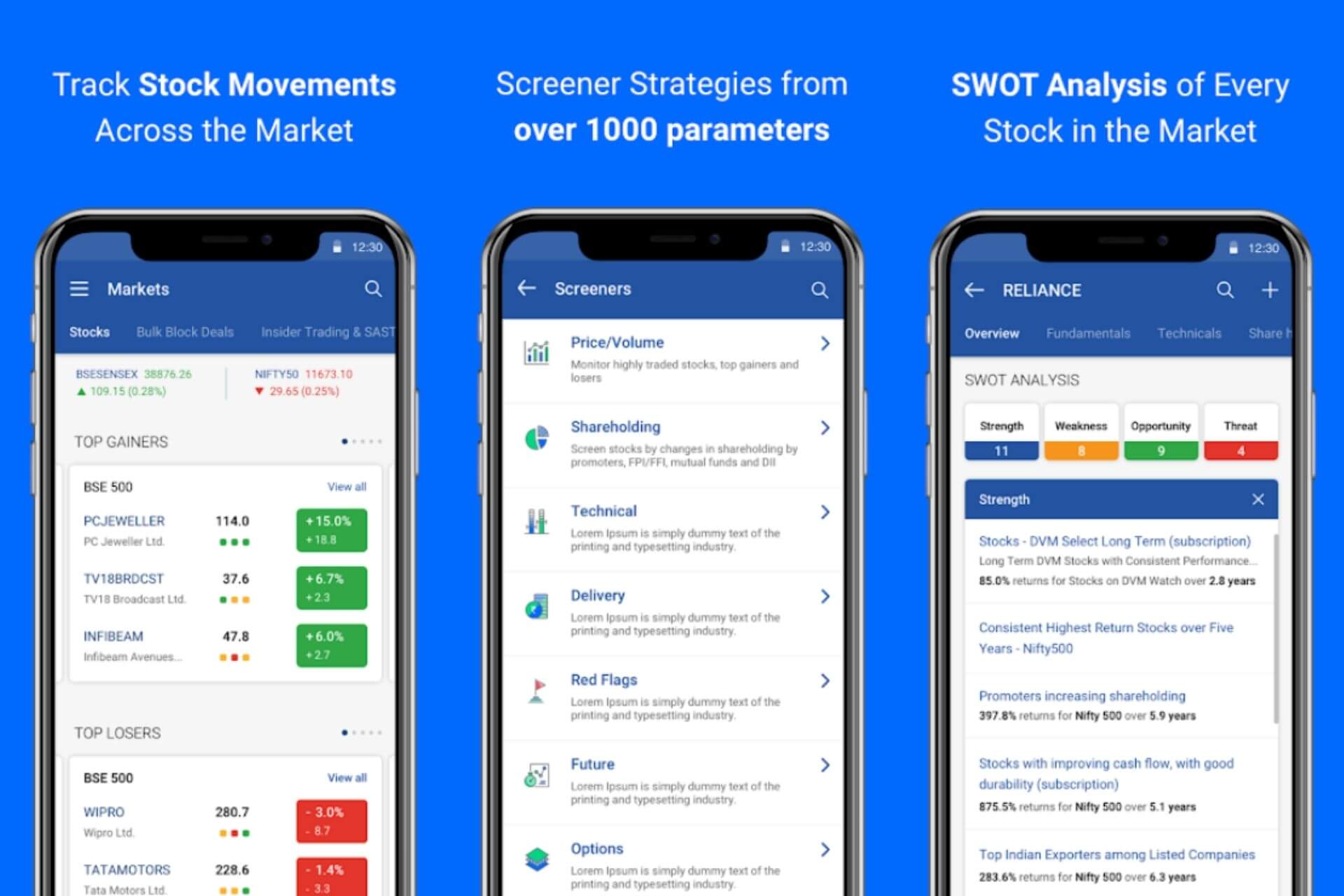

– Variety of features: Share market apps offer a variety of features and tools to help you make the most of your investment.

How to choose the best share market app for you.

Your investment goals will play a big role in determining which share market app is right for you. If you’re looking to simply invest in a few stocks or ETFs and hold them for the long term, then a basic app like Robinhood or Acorns may be all you need. However, if you’re looking to actively trade stocks or other securities, then you’ll need an app with more robust features like TD Ameritrade or E*TRADE.

Do your research.

Once you know what your investment goals are, it’s time to start researching the different share market apps available. This shouldn’t be too difficult, as there are plenty of online reviews and comparisons of the different apps out there. Be sure to read up on the pros and cons of each before making your decision.

Consider the fees.

Finally, don’t forget to consider the fees associated with each share market app. While most of them are fairly reasonable, some can be quite high depending on how often you trade and what type of account you have. Be sure to compare the fees before making your final decision so that you don’t end up paying more than you have to.

How to get started with share market apps.

You will need to open an account with a broker that offers share market apps. When you open an account, you will be asked for some personal information, such as your name, address, and Social Security number. You will also be asked to provide some financial information, such as your income and investment goals. Once you have opened an account, you will be able to fund it using a bank transfer, credit card, or PayPal.

Fund your account.

Once you have opened an account, you will need to fund it before you can start investing. You can fund your account using a bank transfer, credit card, or PayPal. If you are using a bank transfer, you will need to provide the routing number and account number for your broker’s bank account. If you are using a credit card, you will need to provide the card number, expiration date, and security code. If you are using PayPal, you will need to provide your email address and password.

Start investing.

Once you have funded your account, you can start investing in the stock market. You can do this by buying shares of stocks or mutual funds. You can also invest in ETFs (exchange-traded funds) and index funds. To buy shares of stocks or mutual funds, you will need to place an order with your broker. To buy ETFs or index funds, you can simply log into your share market app and purchase them through the app itself.

Conclusion

If you’re looking to get started in the world of investing, share market apps can be a great way to do it. With so many different apps available, it’s important to choose one that best suits your needs. Consider your investment goals, do your research, and compare fees before getting started. Once you’ve opened an account and funded it, you can begin investing in the stock market. With a little patience and diligence, you can soon start reaping the rewards of your investment.