In the world of forex trading online, where every decision carries significant financial implications, mastering the art of candlestick chart analysis is a pivotal skill. Candlestick charts offer a visual representation of price movements, allowing traders to glean a wealth of information from each candle. In this comprehensive guide, we’ll delve into the intricacies of candlestick charts, explore why they outshine traditional charts, differentiate between bar and candlestick charts, and equip you with the knowledge to interpret candlestick patterns effectively. Additionally, we’ll provide insights on choosing a reliable forex trading platform, ensuring you embark on your forex trading in SA journey armed with the confidence and expertise needed for success.

What are Candlesticks?

Candlestick charts are a popular method for visualising price movements in financial markets, including forex. They originated in Japan in the 18th century and have since become an indispensable tool for traders worldwide. Candlestick charts provide a wealth of information in a single glance, making them an ideal choice for both beginners and experienced traders.

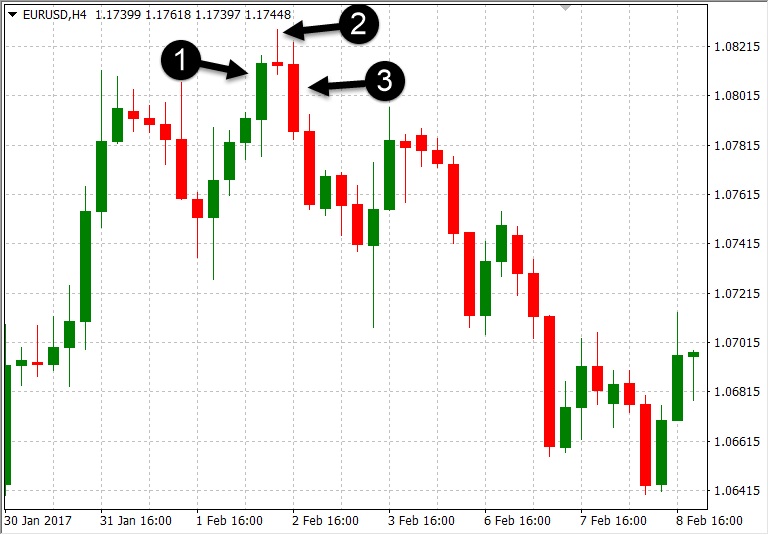

Each candlestick represents a specific time frame, such as a day, an hour, or even a minute. They consist of two main parts: the body and the wicks (or shadows). The body represents the price range between the opening and closing prices during the given time frame, while the wicks show the highest and lowest prices reached within that period.

Why Candlestick Charts Are Preferred by Forex Traders Over Traditional Charts

Candlestick charts have gained an edge over traditional charts for several compelling reasons:

- Clearer Visualisation: Candlesticks convey market sentiment and potential reversals more vividly than traditional charts, allowing traders to quickly identify trends and patterns.

- Price Patterns: Candlestick patterns, such as doji, hammer, and engulfing patterns, provide valuable insights into potential trend reversals and continuation, aiding in precise decision-making.

- Historical Perspective: Candlestick charts offer a historical view of price movements, which is crucial for analysing market behaviour over time.

- Global Adoption: The universality of candlestick charts means that traders from diverse backgrounds can understand and utilise them effectively.

Bar Chart vs. Candlestick Chart

While both bar charts and candlestick charts display price movements, the latter is favoured by many forex traders. The key differences lie in their visual representation:

Bar Charts: Use vertical lines with small horizontal lines on each side to indicate the opening and closing prices.

Candlestick Charts: Use rectangular shapes (bodies) with wicks on both ends to represent the same data.

Candlestick charts are often preferred because they provide a more intuitive and comprehensive view of price action.

How to Read a Candlestick Chart

Understanding candlestick charts requires familiarity with candlestick patterns and the information they convey. Some common patterns include:

- Bullish Engulfing: When a bullish candle completely engulfs the prior bearish candle, it suggests a potential upward trend reversal.

- Bearish Harami: A bearish candle follows a bullish one, indicating a possible reversal of an uptrend.

- Doji: When the opening and closing prices are nearly identical, it signifies market indecision and a potential reversal.

- Hammer: A small body with a long lower wick indicates a bullish reversal after a downtrend.

- Shooting Star: A small body with a long upper wick suggests a bearish reversal following an uptrend.

How to Choose a Reliable Forex Trading Platform in SA?

Selecting the right forex trading platform like Banxso – Online Trading Platform is critical to your success as a forex trader. In South Africa, where forex trading is increasingly popular, consider the following factors when choosing a platform:

- Regulatory Compliance: Ensure the platform is licensed and regulated by relevant authorities in South Africa.

- User-Friendly Interface: Opt for a platform that offers an intuitive interface, making it easy to navigate and execute trades.

- Security Measures: Prioritise platforms with robust security measures, including encryption and two-factor authentication.

- Range of Currency Pairs: Look for a platform that provides access to a wide range of currency pairs to diversify your trading portfolio.

- Customer Support: Prompt and effective customer support can be invaluable when you encounter issues or have questions about trading.

By following these guidelines and incorporating your newfound knowledge of candlestick charts, you’ll be better equipped to navigate the forex market and make informed decisions on your trading platform in South Africa.

In conclusion, mastering the art of reading candlestick charts is an essential skill for any forex trader. It not only enhances your ability to interpret market movements but also empowers you to make strategic decisions that can lead to profitable outcomes in the world of forex trading. So, dive into the fascinating world of candlestick charts and embark on your journey towards forex trading success.