Depending on your risk appetite and tolerance, you may invest your money in one of three tools. Firstly, you have the equity investments, which carry the most risk. The second one includes debt investments, which offer the lowest risk. The hybrid fund schemes are the third and most popular. To achieve their financial objectives, experts advise all investors to have a mix of all plans. The investors may balance the risk-reward ratio with hybrid mutual funds. This will eventually serve to maximise return on investment.

Keep reading to learn how hybrid mutual funds can prove to be a better investment option for you.

What are Hybrid Funds and How Do They Work?

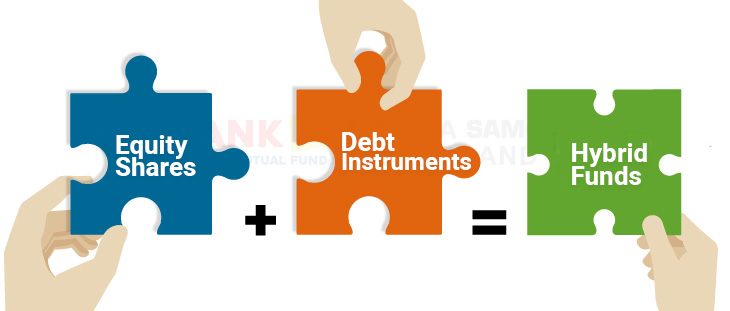

To build a diversified portfolio, hybrid funds invest in many asset types, such as debt, SIP, stock, derivatives, and gold. As per SIP full form and definition, a Systematic Investment Plan offers low risk but a better return of investment when managed efficiently. In a hybrid scheme, you will come across a combination of debt and equity assets. However, a less usual variation can also include investments in a third asset class, such as gold or derivatives.

Hybrid mutual funds are available to investors who want greater returns than pure debt funds and are willing to take on more risk. The risk and possible returns vary from one form of hybrid fund to another, as does the proportion of debt and equity in these vehicles.

As a result, the investor’s risk appetite and financial objectives will determine the investment choice. Hybrid funds can be more debt-oriented or equity-oriented depending on how much of their portfolio comprises of financial instruments like bonds, certificates of deposit, etc.

The two main objectives of investing in hybrid funds are:

- Capital Appreciation in the Medium to Long Term: The plan’s portfolio’s equity component can aid your long-term wealth growth.

- Low Short-Term Volatility: A hybrid fund’s mix of debt instruments can aid in downside protection. In the near term, this can aid in lowering the overall volatility of your investment.

Taxation

According to experts, hybrid funds are more reliable than equity funds and are more likely to produce respectable returns than debt funds. It is possible to determine the rates of taxes on capital gains in line with the Income Tax Act.

The duration of the scheme determines how equity funds undergo taxation. Taxes for short-term capital gains will be 15%, whereas long-term capital gains will be 10% on amounts more than Rs 1 lakh.

Schemes involving debt taxation are like pure debts. Additionally, they will deduct the capital gains from your money and tax it in accordance with the applicable tax slabs. Taxes on long-term capital gains are 20% with indexation and 10% without indexation.

Types of Hybrid Mutual Funds

The four most prominent types of hybrid mutual funds include:

- Aggressive – These funds’ asset under management (AUM) provides investment in debt instruments for the remaining 35%. The rest 65% goes to equities stocks and equity-related investments. The debt instruments might be corporate bonds, non-convertible debentures, government securities, certificates of deposit, commercial papers, etc.

- Conservative – Conservative funds, in contrast to aggressive hybrid funds, allocate about 75% of their AUM to debt securities of prestigious public or private entities. The balance remains invested in equity and securities that relate to equity. Since debt instruments are always less volatile than equity equities, conservative hybrid fund returns are often lower than aggressive funds.

- Multi-Asset Allocation – With a minimum of 10% in each asset class, these products invest in three separate asset classes. These funds are useful for risk management and diversification.

- Balanced – Balanced funds split their equity and debt investments between 40% and 60%. These funds’ main goals are to offer long-term capital growth and lower the chances of capital loss.

Hybrid Fund Advantages

The following are a few advantages provided by Hybrid Fund:

Access Multiple Asset Classes with A Single Fund

One of the obvious benefits of hybrid mutual funds is that an investor may access numerous asset classes in a single product rather than investing in separate funds to fulfil the demand for various asset classes.

Active Risk Management

A hybrid mutual fund offers active risk management through asset allocation and portfolio diversification. By merging non-correlated asset types like debt and equity, they reduce risk.

Diversification

They diversify the portfolio across asset classes as well as within-asset class sub-classes. They invest in large-, mid-, or small-cap equities and value- or growth-oriented firms, just like the total equity allocation.

Automatic Rebalancing

When necessary, the fund management rebalances the portfolio. The investor does not have to do this on his end. They reduce the time and effort needed to manage asset allocation and follow the markets.

Conclusion

In summary, hybrid mutual funds are a subset of mutual funds that invest in multiple asset classes, often a mix of equity and debt assets with the occasional addition of gold. The two main aspects of hybrid funds are diversification and asset allocation. Their objectives are to increase capital through stock allocation and decrease volatility through the portfolio’s debt element.

Risk tolerance levels for hybrid funds range from conservative to moderate to aggressive. They provide novice investors with an excellent entry point into the equity market. Finally, they can use it to save money for any specified medium-term objective.